Stephen Muncaster, ACA

Technical Accounting Expert

Stephen is a technical accounting subject matter expert for Clearwater Analytics, based out of its Edinburgh office.

Stephen is an Alliance Manchester Business School graduate and Chartered Accountant, with a wide variety of post-qualifying business experience. After qualifying, Stephen worked in the commercial sector in a variety of FP&A and financial control roles, including time in corporate finance and acquisitions, before moving into the financial services sector. Stephen has developed significant expertise in financial reporting and compliance with a focus on IFRS and UKGAAP.

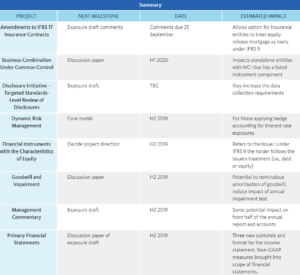

IASB Project Updates

Primary Financial Statements

The opening address focused on the soon-to-be released exposure draft on Primary Financial Statements, which will introduce mandated structure to the income statement by making operating profit one of three defined subtotals and bring management performance measures (non-GAAP) into the scope of the financial statements and resultant audit.

The proposals are the IASB’s response to concerns raised by investors about the comparability of financial statements due to the differing ways firms define operating profit and use non-GAAP measures to explain performance.

Insight: This will have a significant impact on all FTSE 350 filers, as non-GAAP measures are widely used in firms’ reports and accounts and investor results presentations. All non-GAAP measures will be subject to audit and an explanation required as to why an IFRS measure was not used instead. Most listed companies in the UK focus on operating profit in their presentations to journalists as it is within their control to define, whereas statutory profit is not. This will cease under the proposed changes giving the firms less control over how they tell their story.

Dynamic Risk Management

This project will replace portfolio/macro hedging in IAS 39 and covers the process of managing the impact of changes in interest rates on net interest income.

The proposed model is focused on ‘transformation’ and will allow entities to alter their financial assets to meet their risk management objective through the use of derivatives. This is important because matching assets and liabilities does not necessarily align with the fair value or cash flow hedge models.

When derivatives are successful in aligning the asset profile with the target profile, the changes in fair value of the derivatives are deferred in other comprehensive income (OCI) and reclassified to the statement of profit or loss.

IASB’s next steps in this project are to:

- July 2019: Demonstrate the completed core model and discuss operational simplicities with stakeholders via workshops and direct feedback

- Second half of 2019: Outreach on the core model

- The option to apply IFRS 9 or IFRS 17 to some loans that meet the definition of an insurance contract. This means insurers that invest in equity release mortgages can continue to apply IFRS 9 to these investments.

- The requirement to apply other IFRS standards to some credit cards that meet the definition of an insurance contract (e.g., credit cards that provide insurance coverage for a fee)

Based on the feedback received, the IASB will determine the next steps.

Insight: Many firms have continued to use IAS 39 post-IFRS 9 for portfolio hedge accounting or to avoid the additional burden of implementation. Stage 3 and impaired purchased or originated credit-impaired (POCI) assets cannot be used in hedge accounting as their changes in value are dominated by credit risk.

IFRS 17 Insurance Contracts Update

An exposure draft for the new insurance standard has just been published and covers two more scope exclusions:

Insight: Some firms have had to classify equity release mortgages with no negative equity guarantees as insurance contracts under IFRS 4, due to the level of insurance risk in the contract. This option will allow such loans to be considered under IFRS 9.

Relief for IBOR Transition (IBOR Reforms)

The IASB has proposed assistance for firms using IBOR-linked derivatives aimed at avoiding penalties when the rate is phased out. The proposed changes will have an impact upon firms using rate-linked interest rate products as part of their hedge accounting.

To address the issue and help firms avoid penalties, the IASB is issuing two guidance documents:

- Phase 1: Exposure draft was issued May 2019 and provides hedge accounting relief by allowing existing rates to be used in effectiveness testing

- Phase 2: This will apply after the reforms are in force and will include disclosure amendments to IFRS 7 to show the ‘before and after’ results

Insight: Financial institutions make use of interest rate derivatives as part of their hedge accounting. Changing the rates prospectively on the derivatives as a result of the IBOR reform could lead to failing the hedge accounting tests.

If the rate changes cause hedge accounting relationships to fail, this could lead to increased volatility in income statements.

Implementation and Application of the IFRS Standards

A Q&A session was held on current ‘hot topics’ on which the IFRS Interpretations Committee has been asked to advise, together with an overview of the governance for addressing issues raised by investment professionals.

Questions included:

- Regarding credit-impaired (Stage 3) financial asset subsequently cures (i.e., paid in full or no longer credit-impaired): How should an entity present the difference when the asset is no longer impaired?

- Regarding physical settlement of contracts to buy or sell a non-financial item: Should an entity reverse a loss from a derivative liability on physical settlement?

Curing of a Credit-Impaired Financial Asset — Decision

The committee considered if the difference should be posted to interest income or the impairment line.

Conclusion: Allocate to impairment line in the income statement. This is because the asset was bad and is now performing. Therefore, it has recovered. The reduction in interest income and additional impairment that arose from when the asset defaulted is now reversed through the impairment line on the income statement.

Insight: A similar process would be followed for a POCI asset. However, it would never cure, and interest would continue to be recognized on a credit-adjusted effective interest rate ‘net/net’ basis. If the expected recoverable amount was greater than the amortized cost, then a separate allowance would be recognized with the credit put through the impairment line in the income statement. An example of a POCI asset would be a debt security purchased at a deep discount because the issuer is in financial difficulty.

Physical Settlement of a Commodity Derivative

A question was asked regarding the physical settlement of contracts to buy or sell a non-financial item — ‘What if a commodities derivative contract was settled in the commodity rather than cash and the fair value of the commodities derivative was a liability at settlement? Could you reverse losses booked on the derivative?’

The conclusion was no reversal in fair value gains or losses on the derivative would occur as a financial instrument still exists.

Electronic Reporting — Why You Should Care About the IFRS Taxonomy

The conference included a session on electronic reporting, with contributors discussing the use of XBRL taxonomies in the US and internationally.

The IFRS taxonomy is important to IFRS filers in the EU who will need to start filing XBRL-tagged financial reports beginning 1 January 2020 to comply with the European Single Electronic Format (ESEF) directive.

The panel noted that using tagged data enables information to be consumed by investors and avoids the need for expensive intermediary curation, passing control back to the issuers.

For the first two years of ESEF, XBRL tagging is only required for primary financial statements; thereafter the notes will also need to be tagged (as a block). XHTML format will be required for the whole annual financial report from the start.

Insight: While UK firms use an IFRS-based taxonomy to file returns with tax authorities, this cannot be used for ESEF. New processes will be required to deliver. Further, the tagged reports may be within the scope of the external opinion requiring parallel production with the ‘glossy’ report and accounts.

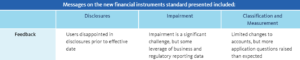

Getting the Best from IFRS 9

A discussion was held on the findings from large companies, banks, and investor analysts on IFRS 9 and IFRS 15.

The key changes from IFRS 9 were further summarized as:

Classification and Measurement

- Date

- Classification: facts only (bus model), no intent

- SPPI if FVOCI (or AC)

- Equities

- No relief for unquoted

- No recycling if OCI

- FVPL as default

Impairment

- Expected loss

- For AC netted against gross carrying value

- For FVOCI booked to liabilities line

- Interest income on a net basis for credit impaired financial assets

Hedging

- Closer to risk management

- Easier to hedge some components

- No bright line test for effectiveness test

- No macro hedge accounting

- Option to continue IAS 39 hedge model

Expected Credit Loss (ECL) Model Discussions:

The panel noted impairment was a huge challenge for financial institutions, but not so challenging for corporates. Banks did not see too much change in impairment levels. This was ascribed to relatively benign credit conditions. A panelist noted the restriction on giving investors updates on ECL model revisions without triggering listing rules around profit updates.

It was noted the IFRS 9 Standard is enforced in France by the Autorite de Normes Comptable (ANC) and they want to harmonize approaches taken by filers across disclosures.

Collateral value is seen as a key determinant on the level of ECL.

Insight: Each firm can adopt a different approach to the same type of credit risk depending upon their internal approaches and risk appetite. Different approaches to modelling probability of defaults can be taken and be equally valid. While the standard greatly improves loss provision accounting, it is at the cost of comparability and greatly increases complexity for the preparers (e.g., cubic splines for PD curves). While collateral was noted as a key determinant of the level of ECL, it plays no part in determining the PD and changes in credit risk since recognition. There are two rebuttable presumptions in the standard, SICR = 30 days or more past due and Stage 3 (default) = 90 days or more past due.

Classification and Measurement Issues

A main issue the panel noted was around classifying equity investments as fair value through other comprehensive income (FVOCI) as opposed to fair value through profit or loss (FVPL), with no recycling of gains and losses on disposal. This has proved to be a challenge for some firms holding strategic equity investments upon conversion to IFRS 9.

Insight: Many insurance companies make use of the Available for Sale category for debt securities and equity shares under IAS 39. This will end under IFRS 9.

Equity securities will need to be fair valued in accordance with IFRS 13 as the cost option has been removed, with changes taken to the income statement. Firms can elect to classify equity holdings as FVOCI if requirements are met. This election is irrevocable and will trap any unrealized gains or losses in reserves once the securities are sold.

More debt securities are likely to be classed FVPL as a result of the new classification and measurement tests under IFRS 9. Any debt securities classified as either amortized cost or FVOCI will need a 12-month (Stage 1) ECL recognized on the date of acquisition. For FVOCI, the ECL is not netted against the asset and is shown on the liability side of the balance sheet.

The views of users of accounts were collated and presented by the IASB at the end of the session:

Benefits

- More information: Fair value of unquoted equities

- Aligns accounting with credit risk management

- No more diversity: ‘Significant or prolonged impairment test’

- Addresses ‘too little too late’

Concerns

- Comparability given increased judgement

- No recycling of FVOCI for equities

- More FVPL = more earnings volatility

Looking Forward

Clearwater is dedicated to keeping European insurers up-to-date on the latest regulatory guidance changes as they pertain to investment accounting and reporting. Be sure to subscribe to Clear Insights and watch for future updates related to the IASB and other topics of interest.